11/07/2019

B3 announces results for the Third Quarter of 2019

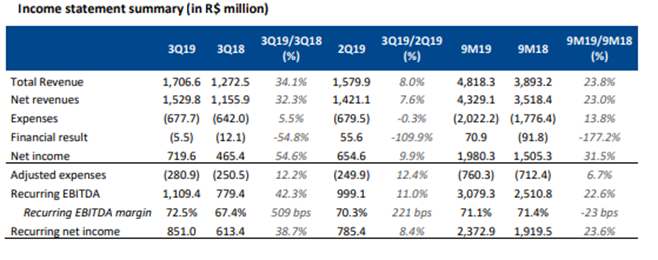

São Paulo, November 7, 2019 – B3 S.A. – Brasil, Bolsa, Balcão (“B3” or “Company”; ticker: B3SA3) reports today its third-quarter 2019 (3Q19) earnings. Total revenues reached R$1,706.6 million, a 34.1% increase over the same period of the previous year (3Q18), while recurring EBITDA1 totaled R$1,109.4 million, up by 42.3%. The Company´s recurring net income2 in 3Q19 totaled R$851.0 million.

Chief Executive Officer of B3, Gilson Finkelsztain, said: “The third quarter was marked by strong activity of our customers in our markets with record volumes in cash equities and listed derivatives, in addition to more than R$70 billion in public equity offerings in the year. In a context of positive expectations after the approval of the social security reform, we remain focused on the execution of our strategy. By aligning our priorities with our client’s needs, we are developing new products and systems, strengthening our operational excellence, and constantly fine tuning our pricing and incentive policies.”

Chief Financial and Investor Relations Officer, Daniel Sonder, added: “Our solid operational performance in the quarter translated into a robust cash generation, underlining our operational leverage and expense discipline. We distributed R$385.0 million in interest on capital and R$264,8 million in dividends, with the total distributed amounting to R$1.6 billion YTD.”

Guidance B3 reaffirms all its guidances for the year:

- Adjusted expenses3 (OPEX): R$1,060 – R$1,110 million

- Revenue-linked expenses: R$245 – R$265 million

- Depreciation and amortization: R$1,000 – R$1,050 million

- Capital expenditures (CAPEX): R$250 – R$280 million

- Indebtedness at YE19: up to 1.5x Gross debt / recurring LTM EBITDA

- Distribution to shareholders: 120% - 150% of IFRS net income

More details on the Company’s guidance are available on the Material Fact released on August 8, 2019.

Noteworthy 3Q19 events – at a glance:

- Changes in the Contract System business model impacted revenues of the Infrastructure for financing and revenue-linked expenses (lower revenues mostly offset by lower revenue-linked expenses).

- Increase in data processing expenses, reflecting IT projects aimed at enhancing the Company’s infrastructure.

- Expenses impacted by the market price of B3SA3 share: o R$32.0 million from provisions for legal disputes, for which a portion of the amount under discussion is updated according to the market price of B3SA3 (in 3Q18, this provision amounted to R$15.3 million).

- Personnel expenses related to long-term stock-based compensation, reached R$41.4 million in 3Q19 in comparison with R$39.7 million 3Q18.

To view the complete report of the Earning Results of B3 for the Third Quarter of 2019, please click here.

B3. With the market. For the future.