Family of Products

The listed derivatives contracts are grouped into families of products, based on each underlying asset. The same price tables will be applied to each family. All contract volumes will be added together to apply reductions by volume.

ADV calculation

The monthly ADV is calculated monthly for each investor, considering all the accounts for the same taxpayer ID (CPF, CNPJ or third block of CVM code) at all the brokerage houses. All accounts linked to a same master account, regardless of the investor, will have their volumes consolidated in the master document linked to it.

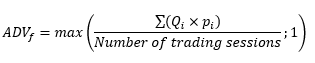

Calculation occurs through the sum of all the traded contracts in a same family (buy and sell, day trade or not) between the first and the last business days of the previous month, divided by the number of trading sessions in the previous month. Each family of products has an ADV, and each contract of the family has a weight for the ADV, which shall be multiplied by the respective number of contracts traded in the period and rounded off to zero decimal places. The ADV will be average of the quantities adjusted by the weight of all the contracts of the family, with this calculation also being rounded off to zero decimal places:

Where:

ADVf = ADV of family of products f;

i = index that denotates each of the products in the same family;

Qi = traded quantity of contracts of each product in the family on each day of the month;

pi = ADV weight for each contract in the family.

In its first trading month, the investor will be placed in the first volume tier of the table.

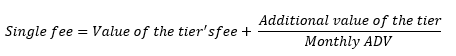

Single fee calculation

Once the ADV of the family of products has been calculated, the next stage will be to calculate the single fee, which is individual to each family. This calculation is made progressively, that is, weighing the values by total transactions in each tier, respecting the limits on the number of contracts for each tier.

| Progressive table | |||

|---|---|---|---|

| Floor | Cap | Tier value | Additional value |

| D1 | U1 | V1 | A1 |

| D2 | U2 | V2 | A2 |

| D3 | U3 | V3 | A3 |

| ... | ... | ... | ... |

| Di-1 | Ui-1 | Vi-1 | Ai-1 |

| Di | Ui | Vi | Ai |

| Dn | Un | Vn | An |

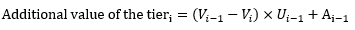

Mathematically, the progressive calculation shall occur as follows:

The additional value of the tier does not come from an additional charge, but from a mathematical mechanism to calculate the average fee:a:

The value of the single fee is rounded off to two decimal places.

Calculating the single fee - Cryptoassets Family

Bitcoin:

Regarding the cryptoassets Bitcoin family, the single fee in BRL it is a result of the following multiplication and rounded to two decimal places:

Where:

NQBTCS = Previous day Nasdaq Bitcoin Reference Price - Settlement, available at https://indexes.nasdaq.com/Index/History/NQBTCS

Exchange Rate USD/BRL = Reference Exchange rate of the previous day, released by B3 and found at https://www.b3.com.br/en_us/market-data-and-indices/data-services/market-data/reports/derivatives-market/indicators/financial-indicators/

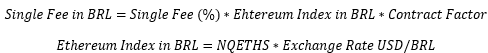

Ethereum:

Regarding the cryptoassets Ethereum family, the single fee in BRL it is a result of the following multiplication and rounded to two decimal places:

Where:

NQETHS = Previous day Nasdaq Ethereum Reference Price

Exchange Rate USD/BRL = Reference Exchange rate of the previous day, released by B3 and found at https://www.b3.com.br/en_us/market-data-and-indices/data-services/market-data/reports/derivatives-market/indicators/financial-indicators/

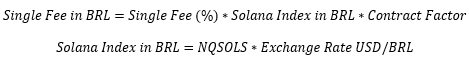

Solana:

Regarding the cryptoassets Solana family, the single fee in BRL it is a result of the following multiplication and rounded to two decimal places:

Where:

NQSOLS = Previous day Nasdaq Solana Reference Price

Exchange Rate USD/BRL = Reference Exchange rate of the previous day, released by B3 and found at https://www.b3.com.br/en_us/market-data-and-indices/data-services/market-data/reports/derivatives-market/indicators/financial-indicators/

Conversion of foreign currency (except Cryptoassets)

The single fee values in foreign currencies shall be converted in Brazilian Reals by the sell PTAX rate on the last day of the previous month. The result shall also be rounded off to two decimal places.

For nonresident investors trading in accordance with CMN Resolution 2687 the value of the single fee in Brazilian Reals will be converted into U.S. Dollars by the sell PTAX rate on the last business day of the previous month and rounded off to two decimal places.

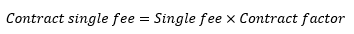

Application of the contract factor (except Cryptoassets)

Each contract from the same family of products has a contract factor, which must be multiplied by the single fee, as calculated in the previous item. The final value shall be rounded off to two decimal places.

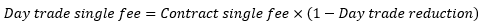

Application of the day trade incentive policy

Prices are reduced on day trades, in the form of a percentage, which shall be applied directly to the single fee calculated in accordance with the previous items. The result of this multiplication shall also be rounded off to two decimal places.

Day trade reduction progressive tables (U.S. Dollar and Index families)

In the case of the progressive table, the final percentage to be applied is obtained in a similar manner, but only considering day trades. The day trade percentage calculation shall be rounded off to two decimal places. The result of the reduction shall be rounded off to two decimal places.

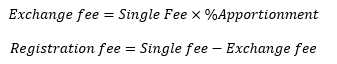

Exchange fee and registration fee

The exchange fee and registration fee shall be defined by apportionment of the single fee charged to the investor (after application of the factors and reductions, if applicable). The exchange fees are calculated from the application of a percentage of the apportionment on the single fee, rounded off to two decimal places. The registration fee will be calculated as the difference between the single fee and the exchange fees.

The value of the apportionment is 35%.

Exchange fee

The unit cost value of the exchange fee, multiplied by the number of contracts for each executed transaction, rounded off to two decimal places.

Registration fee

The unit cost value of the registration fee, multiplied by the number of contracts in each executed transaction, rounded off to two decimal places.

If the single fee value is BRL0.01, this value will be charged on the registration fee. If the value is more than BRL0.01, both the exchange fees and the registration fee will have a BRL0.01 minimum, regardless of the apportionment.

The values obtained for the exchange fees and registration fee are applied on a per transaction basis.

Settlement fee

Applicable to the listed derivatives, except options and spot, upon position closeout at expiration.

The settlement fee is a value fixed per contract. It shall be multiplied by the number of settled contracts, rounded off to the second decimal place. In the case of physical delivery settlement, the settlement fee is a percentage to be applied to the settled value, rounded off to two decimal places, except cryptoassets.

Regarding the Cryptoassets family, the settlement fee still is a fixed value, that should be multiplied by the previous day Nasdaq Bitcoin Reference Price and then multiplied by the amount of settled contracts, rounded to two decimal places.

Permanence fee

The derivatives contracts of this item are exempted from the permanence fee charge.