Fee schedule valid as of January 14, 2019.

| Base contracts for the average |

|

| Applicable contracts |

|

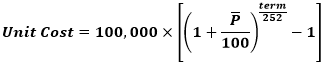

Specific unit cost calculation

Where:

Unit Cost = the cost calculated for the exchange fee or the variable registration fee for one contract;

= average cost calculated for the exchange fee or the variable registration fee, based on the ADV and the tables below, on a progressive way;

= average cost calculated for the exchange fee or the variable registration fee, based on the ADV and the tables below, on a progressive way;

Term = term given by the difference between the maturity date of the option and the maturity date of the underlying future. Limited to 290 days.

Exchange fee and registration fee – fixed and variable components

| ADV | Exchange fee | Registration fee | ||

|---|---|---|---|---|

| From | To | Variable component | Fixed component (BRL) | |

| 1 | 250 | 0.0003703 | 0.0003015 | N/A |

| 250 | 2,500 | 0.0003518 | 0.0002865 | N/A |

| 2,501N/Q | 7,000 | 0.0003147 | 0.0002530 | N/A |

| 7,001 | 15,000 | 0.0002962 | 0.0002412 | N/A |

| 15,001 | 25,000 | 0.0002777 | 0.0002262 | N/A |

| More than 25,000 | 0.0000741 | 0.0000603 | N/A | |

Incentive policies

- Structured Options: unit cost calculated for the exchange fee and the variable registration fee only charged to the option;

- Daytrade: 30% of the unit cost calculated for the exchange fee and the variable registration fee of the futures;

Options exercise

Exercise of options on DI1 futures contracts will be charged as a DI1 futures contract.