Ibovespa Futures

Mini Ibovespa Futures Contract - Features

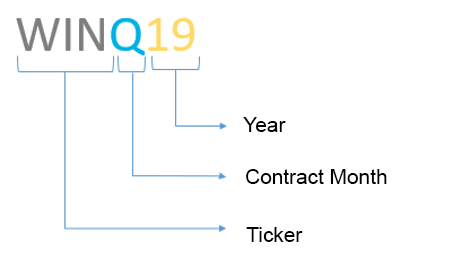

The Mini Ibovespa Futures Contract is traded through the ticker WIN. Its trading hours is between 9:00 a.m. and 6:00 p.m. The contract size is the amount of Ibovespa points multiplied by BRL0.20 and its minimum variation is 5 index points. Expiration occurs in even months, on the Wednesday nearest to the 15th day of the contract month.

The round lot consists of one minicontract.

Ticker and expiration

| Expiration | Letter |

|---|---|

| February | G |

| April | J |

| June | M |

| August | Q |

| October | V |

| December | Z |

Collateral

To trade a standard Mini Ibovespa Futures Contract round lot, investors must deposit a percentage of the total contract value as collateral. For day trades, collateral is defined by the brokerage house. For trades that last more than one day, collateral is defined by B3.

Example of a day trade

A brokerage house defined as collateral for a day trade 0.5% per mini U.S. Dollar contract. In this example, investors may trade a mini contract by depositing BRL104.00 as collateral per mini contract.

104,000 points x BRL0.20 x 0.5% = BRL104.00

Daily settlement for the Mini Ibovespa Futures Contract:

Purchase of 1 Mini Ibovespa Futures Contract at 104,000 points (PO)

Settlement price on the day: 104,200 (PAt)

The settlelment value (ADt) will be:

(104,200 – 104,000) x BRL0.20 x 1 contract

ADt= R$ 40,00

Equation: ADt=(PAt -PO) x M x N

ADt is the daily settlement in Brazilian Reals on the t date

PAt is the settlement price in Brazilian Reals on the t date

PO is the trade price in Brazilian Reals

N is the number of contracts

M is BRL0.20 per index point