Fee Structure

This fee policy will be applicable for securities lending and specific repo transactions with centrally cleared federal government bonds that are contracted by the parties and registered OTC. The B3 fees will be based on the rate, value and term of the agreements. The fee structure has four variations, namely: lending or repo transactions with federal government bonds, with a fixed or floating rate. The annualized fee percentage will be defined in accordance with the transaction and will subsequently be used to calculate the fee in Brazilian Reals. The fee will be paid by the borrower in the case of securities lending and by the buyer in the case of repos.

Calculation of the annualized fee percentage – Securities lending

The borrower pays the lending agreement’s rate to the lender. The fee calculation is based on this rate.

Fixed rate securities lending

The fixed rate fee percentage will be defined as:

Where:

i = the fee to be applied to the volume and term of the agreement, rounded off to eight decimal places, in decimal form

α = fee percentage defined by B3, rounded off to eight decimal places, in decimal form

Agreement rate = annualized fixed rate negotiated between the lender and borrower rounded off to eight decimal places, in decimal form

Floor = minimum fee defined by B3 rounded off to eight decimal places, in decimal form

Cap = maximum fee defined by B3 rounded off to eight decimal places, in decimal form

Floating rate securities lending

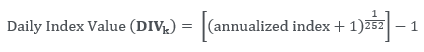

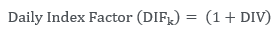

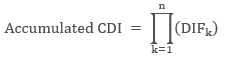

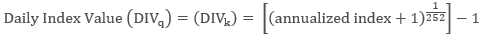

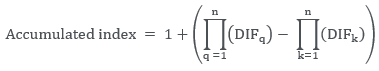

First, the Accumulated index is defined as:

Where:

Annualized index = CDI or SELIC rates, calculated daily and expressed annually, rounded off to eight decimal places, in decimal format

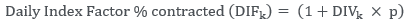

Daily Index Value (DIV) = rounded off to eight decimal places, in decimal format

Daily Index Factor (DIF) = rounded off to sixteen decimal places, in decimal format, accumulated daily

P = % contracted index, rounded off to eight decimal places, in decimal format

n = number of business days in the period between the contracting date (excluding) and the multilateral net settlement date (including). In the case of renewal, the period considered is that between the contracting date (excluding) and the renewal date (including)

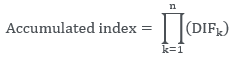

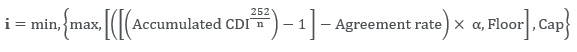

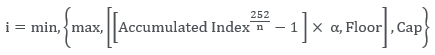

With the accumulated index, the floating rate fee percentage will be defined as:

Where:

i = fee to be applied to the volume and term of the agreement, rounded off to eight decimal places, in decimal form

α = fee percentage defined by B3, rounded off to eight decimal places, in decimal form

Accumulated index = Product operator of the accumulated DIF values, rounded off to eight decimal places, in decimal format

n = number of business days in the period between the contracting date (excluding) and the multilateral net settlement date (including). In the case of renewal, the period considered is that between the contracting date (excluding) and the renewal date (including). The portion (252/n) is truncated in eight decimal places

Floor = minimum fee defined by B3 rounded off to eight decimal places, in decimal form

Cap = maximum fee defined by B3 rounded off to eight decimal places, in decimal form

Calculation of the annualized fee percentage – Specific repos

The seller (provides the security) remunerates the buyer (invests cash) at a rate defined between the parties. The cost of the transaction is thus the opportunity cost between 100% of the CDI and the remuneration rate.

Fixed rate specific repos

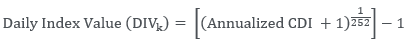

First, the Accumulated CDI is defined as:

Where:

Annualized CDI = CDI rate, calculated daily and expressed annually, rounded off to eight decimal places, in decimal format

Daily Index Value (DIV) = rounded off to eight decimal places, in decimal format

Daily Index Factor (DIF) = rounded off to sixteen decimal places, in decimal format, accumulated daily

n = number of business days in the period between the contracting date (excluding) and the multilateral net settlement date (including). In the case of renewal, the period considered is that between the contracting date (excluding) and the renewal date (including)

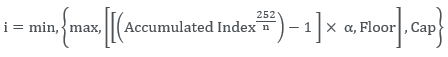

With the Accumulated CDI, the fixed rate fee percentage will be defined as:

Where:

i = fee to be applied to the volume and term of the agreement, rounded off to the eight decimal place, in decimal form

α = fee percentage defined by B3, rounded off to eight decimal places, in decimal form

n = number of business days in the period between the contracting date (excluding) and the multilateral net settlement date (including). In the case of renewal, the period considered is that between the contracting date (excluding) and the renewal date (including). The portion (252/n) is truncated in eight decimal places

Agreement rate = annualized fixed rate, negotiated between the buyer and seller, rounded off to eight decimal places, in decimal form

Floor = minimum fee defined by B3 rounded off to eight decimal places, in decimal form

Cap = maximum fee defined by B3 rounded off to eight decimal places, in decimal form

Floating rate specific repos

First, the Accumulated index is defined as:

Where:

Annualized index = CDI or SELIC rates, calculated daily and expressed annually, rounded off to eight decimal places, in decimal format

Daily Index Value (DIV) = rounded off to eight decimal places, in decimal format

Daily Index Factor (DIF) = rounded off to sixteen decimal places, in decimal format, accumulated daily

P = % contracted index, rounded off to eight decimal places, in decimal format

n = number of business days in the period between the contracting date (excluding) and the multilateral net settlement date (including). In the case of renewal, the period considered is that between the contracting date (excluding) and the renewal date (including)

q = index itself

k = contracted index

With the Accumulated index, the floating rate fee percentage will be defined as:

Where:

i = fee to be applied to the volume and term of the agreement, rounded off to the eighth decimal place, in decimal form

α = fee percentage defined by B3, rounded off to eight decimal places, in decimal form

Accumulated index = Product operator of the accumulated DIF values, rounded off to eight decimal places, in decimal format

n = number of business days in the period between the contracting date (excluding) and the multilateral net settlement date (including). In the case of renewal, the period considered is that between the contracting date (excluding) and the renewal date (including). The portion (252/n) is truncated in eight decimal places

Floor = minimum fee defined by B3 rounded off to eight decimal places, in decimal form

Cap = maximum fee defined by B3 rounded off to eight decimal places, in decimal form

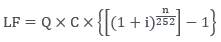

Fee calculation in Brazilian Reais

The formula to calculate the fee in Brazilian Reals has only changed regarding the value of the percentage fee (i), calculated in previous items:

Where:

LF = value to be paid in the period in Brazilian Reals, rounded off to the second decimal place

Q = quantity of assets

C = price quotation of the underlying asset, according to the Anbima market price on T-1 of the start of the agreement

i = fee in decimal form, as defined in the formula of the corresponding transaction corresponding to item 3

n = number of business days in the period between the contracting date (excluding) and the multilateral net settlement date (including). In the case of renewal, the period considered is that between the contracting date (excluding) and the renewal date (including). The portion (n/252) is truncated in eight decimal places.