| Base contrats |

|

| Applicable contracts |

|

Specific unit cost calculation

The specific unit cost calculation is different for the option buyer (holder) and the option seller (writer):

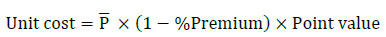

Holder:

Writer:

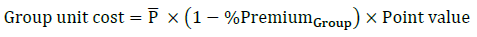

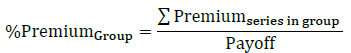

Grouping of Series

When options with the same expiration date are bought in the same trading session, for the same account but in different series (different Copom decision scenarios), the contracts in transactions not characterized as day trades are grouped together for fee calculation purposes.

Ex. 1: 100 series A contracts and 100 series B contracts form a group with 100 A/B contracts

Ex. 2: 150 series A contracts and 100 series B contracts result in group 1 with 100 A/B contracts and group 2 with 50 series A contracts

Where:

Unit Cost = value calculated for the exchange fee or registration fee for one contract;

P = value in points of the exchange fee and the registration fee based on the ADV and the tables, in a regressive form.

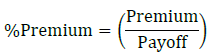

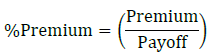

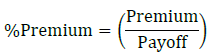

%Premium = percentage calculated for each transaction by dividing the premium agreed by the parties (in points) by the size of the option contract, also in points (payoff):

Point Value = BRL1.00

Exchange fee and registration fee

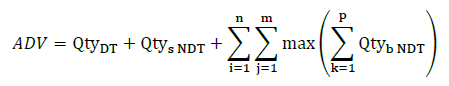

The calculation of the ADV for each investor considers the grouped quantity of bought contracts in transactions not characterized as day trades for each account.

Where:

ADV = Daily ADV for each investor or master account;

Qty DT = sum of the quantities (buy and sell) of contracts characterized as day trades in all accounts for the same investor or ID;

Qtde s NDT = sum of the quantities of sell contracts not characterized as day trades in all accounts for the same investor or ID;

i = index denoting each of the accounts for the same investor or ID;

j = index denoting each of the contract months traded for the same account;

k = index denoting each of the series traded for the same account;

Qty b NDT = quantity of buy contracts not characterized as day trades in the same series and with the same expiration date, for the same account, but in different trades.

The table is regressive, based on the daily ADV for each investor or ID on each participant.

| Daily ADV | Exchange fee (points) | Registration fee (points) | |

|---|---|---|---|

| From | To | ||

| 1 | 2,500 | 0.27 | 0.83 |

| 2,501 | 6,000 | 0.25 | 0.75 |

| 6,001 | 12,000 | 0.22 | 0.68 |

| 12,001 | 16,500 | 0.20 | 0.60 |

| 16,501 | 25,000 | 0.17 | 0.53 |

| More than 25,000 | 0.15 | 0.45 | |

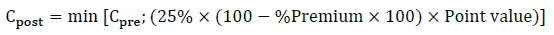

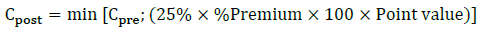

Relative cap (holder)

Where:

Cpost = sum of the exchange fee and registration fee after application of the cap;

Cpre = sum of the exchange fee and registration fee calculated;

%Premium = percentage calculated for each transaction by dividing the premium agreed by the parties (in points) by the size of the option contract, also in points (payoff):

Point value = BRL1.00

The cap value will be applied independently for each group formed, considering the premium consolidation for options with the same maturity.

In case of grouping (buy of more than one series with the same maturity, the premium value used for the cap application will be the one for the group formed.

Relative cap (writer)

Where:

Cpós = sum of the exchange fee and registration fee after application of the cap;

Cpre = sum of the exchange fee and registration fee calculated;

%Premium = percentage calculated for each transaction by dividing the premium agreed by the parties (in points) by the size of the option contract, also in points (payoff):

Point value = BRL1.00

Incentive Polices

The incentive polices below apply to the exchange fee and the registration fee.

- Daytrade: 30% of the unit cost calculated for the exchange fee and registraton fee

Option exercise

The execise for Copom Option will be exempt.