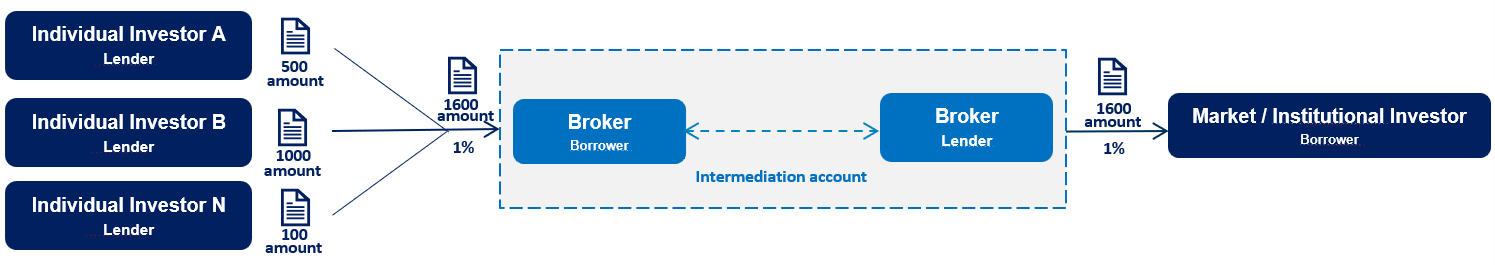

Intermediation account

The intermediation account is a feature that enables the broker to facilitate individual investors in the securities lending market, especially investors with low amount.

Using the intermediation account, the broker borrows the individual investors’ assets who chose to lend. The broker groups them into a single contract and at the other side of the transaction, through the intermediation account, the broker lends the individual investors’ assets in a single contract for market clients who act as borrowers in the same amount, rate and due date.

Eligibility:

- Individual investor

- Investment clubs

- Non-financial PJ

The feature has specific numbering and the possibility of a second account per Broker. It can be used by full trading participants (PNPs) and settlement participants (PLs) and has the exclusive purpose of contracting loans for intermediation.

Benefits:

- More agility and gains in scale for brokers;

- Enables individual investors to be lenders even with low amounts;

- Tax exemption when brokers act as borrower through intermediation account;

- Stability for the contract (the intermediation account enable the change of the individual investor lender without the need to settle the all transaction).

How the trade works

The trade can be done over the counter or electronic trading.

OTC:

PNP signs contracts with your individuals investors lenders through the intermediation account.

- Executor, carrying and custodian must be the same PNP.

- PNP signs a contract with the borrower market with the intermediation account as the opposite part.

- Using a screen or message, the PNP will register the intermediation indicating the contracts borrowed and lent by the intermediation account.

- Automatic validation of parameters

- Amount lent = Amount borrowed

- Same due date

- Same object asset

- Lender rate = Borrower rate

- Types of Lenders

- Contracts must be reversible.

- Maximum grace period of 1 business day

- RTC will generate intermediation code.

Electronic platform trading:

PNP inserts through BTB electronic platform trading the intermediation account’s lend offer

- For each attack carried out by the market on the lend offer, BTB will generate 2 different business with the same characteristics, linked by an identifying code:

- Business 1: intermediation account as the lender end and participant who attacked the lend offer as the borrower.

- Business 2: intermediation account as the borrower and participant’s capture account as lender.

- The PNP responsible for intermediation must allocate the lender side of business 2 to its individual investor clients, within the deadlines established for the capture account. Unallocated amounts will be sent to the error account. Validation of the profile of lenders clients in the allocation.

- There can’t be any reallocation of the business allocated to the intermediation account.

- At the end of the allocation grid, the RTC will generate contract numbers for each business and using the identifier received from BTB, it will automatically generate the intermediation code.

NOTE: Contracts that are from an intermediation can’t be changed.

Roteiro De Certificação:

Acesse o Roteiro de certificação para testar a funcionalidade no ambiente de certificação.