Module for recording Stock Options with more flexible deadlines and non-standard values.

It covers all shares traded on the domestic stock exchange market and ETFs, funds that seek to return a certain index with shares traded on the stock exchange. Through this agreement, upon payment of an initial premium (which is only a fraction of the spot price), the investor will be entitled to receive the share appreciation that exceeds a certain amount (called the strike price). On the other hand, if there is no expected valuation, the maximum loss will be the premium invested. One way to lower the cost of the initial premium is to include a High Limiter.

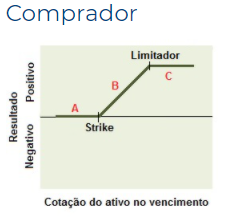

Flexible Stock Options have the possibility of indicating protection for cash proceeds resolved by the company issuing the stock subject to the option. Among the formats of operations that can be developed by institutions that operate with Stock Options, we have, below, an example of an operation for the investor who believes in the valuation of a certain stock, and who does not want to make the physical purchase of the asset on the stock exchange. The chart shows the result of a call option with High Limit.

The contracts are only registered after confirmation by those involved and, once processed, the calculations related to payment events are made by B3 itself. The financial settlement of the premium and the exercise also occurs in the financial market integrator, reducing the operational risk.

Main Features of the Options Module

- Automatic capture of quotes.

- Indication of whether there will be adjustment (protected option) due to cash payments.

- Possibility of using high / low limiter or Knock-in / Knock-out.

- Automatic adjustment of exercise prices.

- Flexibility in the definition of premium rebate value.