Studies conducted by consultants in Europe and the US explored opportunities to increase efficiency in the post-trading process, such as trade confirmation and pre-matching, which might reduce the settlement cycle from T+3 to T+2. In the Brazilian model, the trades are already locked in for settlement and there is no confirmation stage. However, the process of customer identification (allocation), custodian transfer authorization and pre-matching occurs on T+1 and T+2, leading to T+3 settlement.

Benefits

- Reduction of counterparty risk for individual investors, participants and CCP.

- Greater efficiency in post-trading processes, thus reducing costs.

- Operational risk reduction.

- Increased availability of capital

Regulatory Approval

We hereby inform you that on May 14, 2019, the Central Bank of Brazil (BCB) and the Securities and Exchange Commission of Brazil (CVM) granted B3 the authorizations necessary for implementation of the T+2 Settlement Cycle Project, which consist of reducing the settlement cycle of the cash equities market from T+3 to T+2.

Having received the required authorizations from the regulatory bodies and concluded tests at the BM&FBOVESPA Clearinghouse platform, we will implement the T+2 settlement cycle on May 27, 2019, on which date there will be the first trading session for the cash equities market with transactions contracted for settlement on T+2 , that is, on May 29, 2019.

Project Phases

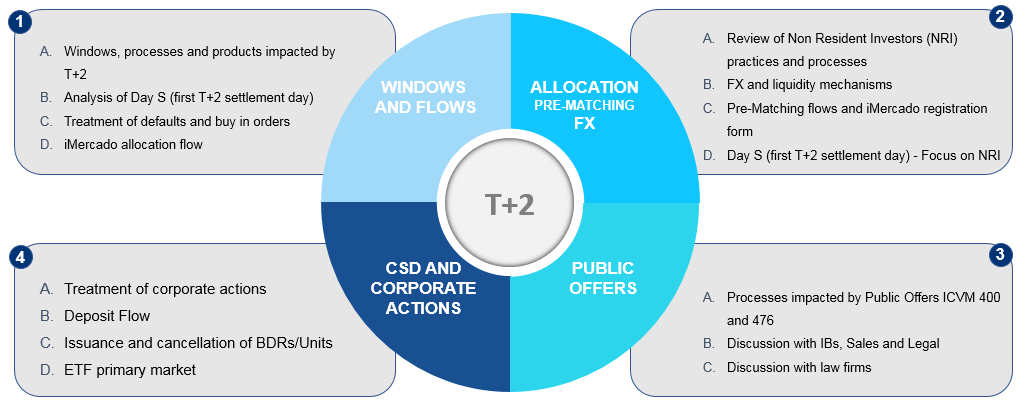

The Project specification is under construction together with the Brazilian market players, so that everyone can contribute with the construction of the business model and with the definition of timeframe of tests and implementation. A total of 29 working group meetings were held from February to March 2018 to discuss i. Windows and Flows, ii. Allocation, pre-matching, FX, iii. Public Offers, and iv. CSD and Corporate Actions, aiming to analyze the process and discuss alternatives to provide greater efficiency with lowest possible impact in the financial market. The main topics discussed with the working groups were:

B3 has organized two working groups to present the proposed model to hear the feedbacks regarding the process and implementation deadlines. We consolidated all market feedbacks and communicated (018/2019-VOP) the project's scheaule.

| Phase | Scope | Certification | S day simulation schedule (first T+2 settlement day) | Expected implementation |

| Phase 1 | Shortening of settlement cycle to T+2 |

Cycle 1 – Starts on Feb. 25, 2019. End of certification scheduled for March 7, 2019. Cycle 2 – Starts on March 11, 2019. End of certification scheduled for March 20, 2019. Cycle 3 – Starts on April 1, 2019. End of certification scheduled for April 10, 2019. Cycle 4 – Starts on April 22, 2019. End of certification scheduled for May 3, 2019. |

First simulation – Starts on February 7 Scheduled to end on February 13, 2019. Second simulation – Starts on March 21. Scheduled to end on March 29, 2019. Third simulation – Starts on April 11, 2019. Scheduled to end on April 18, 2019. Forth simulation - Starts on May 2, 2019. Scheduled to end on May 10, 2019. |

May. 27th 2019 |

| iMercado (allocation, pre-matching, NRI registration) |

iMercado Pre-Matching: May. 13th 2019 iMercado NRI Registration: May. 6th 2019 |

Technical workshops will be held from July 2018 for alignment on all aspects of Project T+2 for the participants and clients involved.