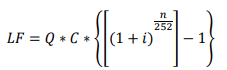

The lending trading and post trading fees are calculated as follows:

Where:

LF = settlement fee in BRL;

Q = number of contracts;

C = registered contract quotation;

n = number of business days between the registration date(excluded) and the settlement by multilateral net balance date (included).In case of renewal the period is between the registration date (excluded) and the renewal date (included). The portion (n/252) is truncated in eight decimal places;

i = settlement fee value, in bps/year, calculated as follows:;

Where:

= cost percentage, as table below;

Lending Fee = fee negotiated between lender and borrower;

Floor = minimum fee in bps/year;

Cap = maximum fee in bps/year.

|

|

|

|

|

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

|

|

|

(bps/ano) |

(bps/ano) |

|

(bps/ano) |

(bps/ano) |

|

(bps/ano) |

(bps/ano) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | ||

|---|---|---|---|

|

|

|

(bps/ano) |

(bps/ano) |

|

|

|

|

|

|

|

|

|

|