In order to calculate the risk for the closeout of a portfolio consisting of positions and collateral from several markets and asset classes, B3 developed an innovative risk measure: Close-Out Risk Evaluation (CORE).

Key CORE benefits:

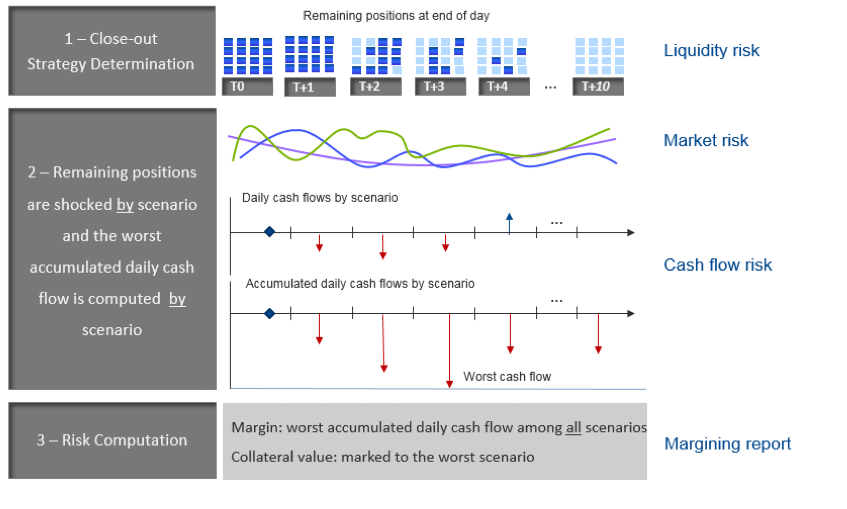

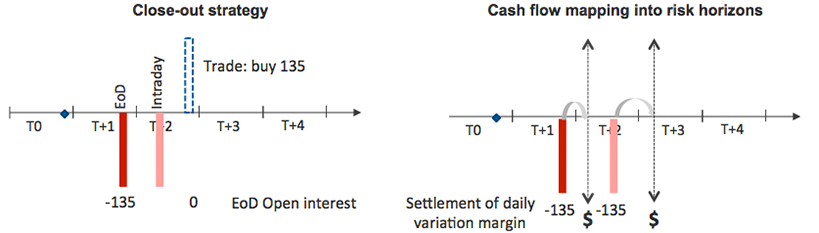

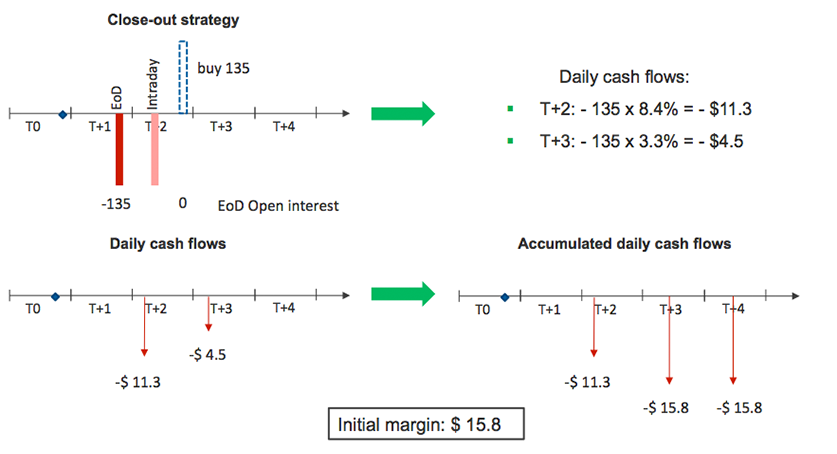

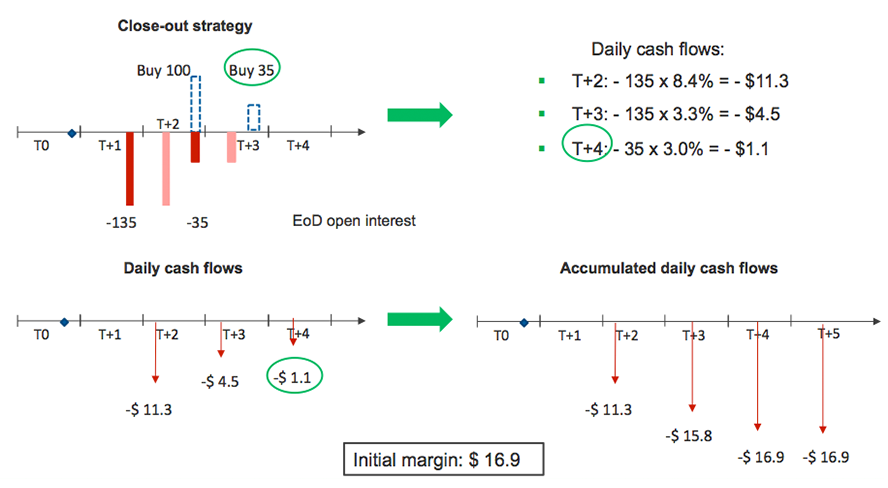

- It calculates the worst accumulated cash flow during the portfolio closeout process

- It calculates the joint risk for positions and collateral

- It models three types of risk: market, liquidity for positions and collateral, and cash flow

- Accurate closeout strategy: position closeout transactions and collateral execution

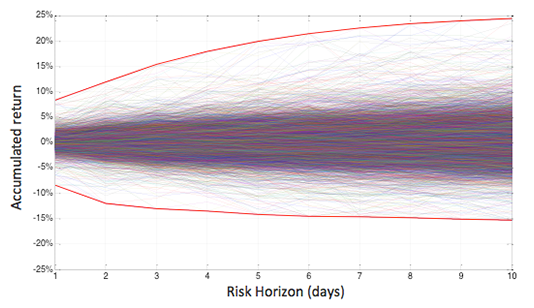

- Severe loss (stress test): confidence level of 99.96% or 10Y crisis

- It considers 10,000 scenarios: historical (since 2002), quantitative and prospective

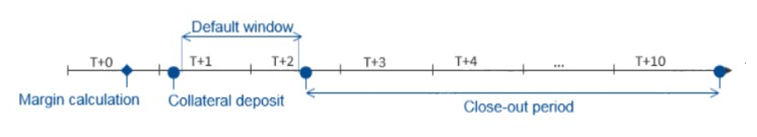

- Multi-horizon: daily closeout operations (1 to 10 days)

- It apllies full valuation