| Base contracts for the average |

|

| Applicable contracts |

|

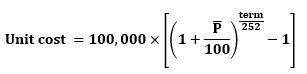

Specific unit cost calculation

Where:

Unit Cost = the cost calculated for the exchange fee or the variable registration fee for one contract;

= average cost calculated for the exchange fee or the variable registration fee, based on the ADV and the tables below, on a progressive way;

= average cost calculated for the exchange fee or the variable registration fee, based on the ADV and the tables below, on a progressive way;

Term = term of the operation, in reserve days, limited to a minimum of 1 and maximum of 290 days.

Exchange fee and registration fee - fixed and variable components

| ADV | Exchange fee | Registration fee | ||

|---|---|---|---|---|

| From | To | Variable component | Fixed component (BRL) | |

| 1 | 100 | 0.0006732 | 0.0005482 | N/A |

| 101 | 1,260 | 0.0006396 | 0.0005209 | N/A |

| 1,261 | 2,800 | 0.0005722 | 0,0004660 | N/A |

| 2,801 | 7,300 | 0.0005386 | 0.0004386 | N/A |

| 7,301 | 47,900 | 0.0005049 | 0.0004112 | N/A |

| More than 47,900 | 0.0004376 | 0.0003563 | N/A | |

Incentive Policies

The incentive policies below affect only the exchange fee and the variable registration fee. The fixed registration fee remains the same as described on the table.

- Options: 55% of the unit cost calculated for the exchange fee and the variable registration fee;

- Daytrade:

- Future: 35% of the unit cost calculated for the exchange fee and the variable registration fee;

- Options: 50% of the unit cost calculated for the exchange fee and the variable registration fee.

Permanence fee

| Contract | Reduction factor (λ) | Value per day (p) |

|---|---|---|

| OC1 | 0.73 | BRL0.00816 |

This fee is not charged for options.

Settlement fee

For the OC1 contracts, a settlement fee of BRL0.01166 will be charged at the settlement.

Options exercise

Exercise of ITC options will be charged as an ITC option.