New Traders Program

New Nonresident Traders Incentive Program – Cycle 2023This policy is effective as of January 24, 2023 and will remain in effect until December 31, 2023

Purpose

Have you ever thought of becoming a trader in the Brazilian financial market?

The New Traders Program Cycle 2023 was created to encourage traders associated with proprietary trading firms based abroad who do not have previous experience in the Brazilian market to join the markets managed by B3, as described in the New Nonresident Traders Incentive Program Rules - Cycle 2023.

In this program, new traders will benefit from exemptions on exchange fees and other charges when carrying out trades with listed contracts, such as derivatives and cash equities. These incentives will be granted through a program of points offered to traders.

Adhesion to the New Traders Program Cycle 2023

To join the program, interested firms shall send the Firm Instrument of Agreement for B3’s assessment as per the template attached hereto as Annex I f the circular letter at the end of the page.

The Firm’s Instrument of Agreement must be submitted to B3 by a trading participant (PN) or full trading participant (PNP), which will be responsible for verifying the firm’s powers of representation by filing a request with B3’s Service Portal at “Programa de Incentivo para Novos Operadores Não Residentes – Ciclo 2023”, which can be accessed at atendimento.b3.com.br/programadeincentivor

B3 will analyze the request to join the Program, and once compliance with all requirements has been confirmed, it will inform the requesting PNP or PN of the firm’s approval.

Eligibility firms must:

(i) Be nonresident institutions complying with the provisions under CMN Resolution 2,687/2000 or CMN Resolution 4,373/2014;

(ii) Trade with their own resources;

(iii) Have at least 50 traders operating in global markets (other exchanges than B3);

(iv) Have a day-trade volume of more than 75% of their total trading volume during the participation in the New Traders Program Cycle 2023;

(v) Not participate and not request participation, during the term of the New Traders Program Cycle 2023, in other Incentive Programs for New Nonresident Investors;

(vi) Not be registered in the High Frequency Traders program or as market makers in the same accounts that will be used for the New Traders Program Cycle 2023;

(vii) Trade solely by unautomated or ISVs synthetic order generation strategies with human parameterization throughout the day in the accounts registered in the New Traders Program Cycle 2023;

(viii) Not trade with High Frequency and Systematic Trading models;

(ix) Not use co-location as their DMA connectivity.

Eligible traders must:

(i) Have no previous experience in trading the eligible products traded in the markets managed by B3 described in item 2 below. A trader with previous experience is that who has carried out any type of trade involving eligible products in the markets managed by B3;

(ii) Never have participated in the New Traders Program Cycle 2023 before, even representing another firm nor in the Nonresident Traders Incentive Program Cycle 2018, 2019, 2020 2021 and 2022, as set forth by Circular Letter 006/2017-DN, 001/2019-VPC, 001/2020-VPC, 186/2020-VPC and 012/2021 VPC, respectively.

Timeframe

The incentives will be valid for up to twelve (12) months from B3’s approval of trader registration in the New Traders Program Cycle 2023 or until all points are consumed, whichever occurs first.

Withdrawal

In the event that a partner institution chooses to withdraw from the program before the end of the full term, the firm must send an email to the designated RM to assist its team.

Calculation Rules

To encourage participation, fee exemptions will be granted to registered traders in the form of a bonus of 10,000 points per trader. These points are personal and non-transferable and may be used exclusively to trade eligible products.

The substitution of traders during the New Traders Program Cycle 2023 is allowed, regardless of the consumption or not of the franchise points. The relationship between points and products follows the established program of points

Eligible Products

On applying for registration, the firm must designate, among the items listed below, the products that will be traded for the purpose of controlling the traders’ incentives.

Interest Rates Group

- One-Day Interbank Deposit Futures Contract (DI1)

- DI x IPCA Spread Futures (DAP)

- Structured Transaction of Forward Rate Agreement on DI x U.S. Dollar Spread (FRC)

FX Group

- U.S. Dollar Futures Contract (DOL)

- Mini U.S. Dollar Futures Contract (WDO)

- Structured U.S. Dollar Rollover Transaction (DR1)

- Structured Mini U.S. Dollar Rollover Transaction (WD1)

Equities Group

- Ibovespa Futures Contract (IND)

- Mini Ibovespa Futures Contract (WIN)

- Structured Ibovespa Rollover Transaction (IR1)

- Structured Mini Ibovespa Rollover Transaction (WI1)

- Cash Equities (stocks, BDRs, ETFs, units, investment fund shares, subscription warrants, subscription receipts, subscription rights)

Commodities Group

- 4/5 Arabica Coffee Futures Contract (ICF)

- Live Cattle Futures Contract (BGI)

- Hydrous Ethanol Futures Contract (ETH)

- Corn Futures Contract (CCM)

Incentives

Each registered trader will be entitled to exemptions on exchange fees and other fees arising from transactions with the eligible products, as described below.

Program of Points

Each contract or equity asset traded represents a quantity of points, regardless of the nature or type of security, contract month, term, or type of equity asset or option type, as shown in the table below:

| Product | Points per contract |

|---|---|

| Interest Rate Group | |

| DI1 | 0,12 |

| DAP | 0,22 |

| FRC | 0,39 |

| FX Group | |

| DOL | 0,67 |

| WDO | 0,13 |

| DR1 | 1,37 |

| WD1 | 0,37 |

| Equities Group | |

| IND | 0,17 |

| WIN | 0,03 |

| IR1 | 0,56 |

| WI1 | 0,11 |

| Commodities Group | |

| BGI | 0,30 |

| CCM | 0,10 |

| ETH | 0,66 |

| ICF | 0,76 |

| Product | Product Points per BRL1.00 traded |

|---|---|

| Cash equities (stocks, BDRs, ETFs, units, investment fund shares, subscription bonuses, subscription receipts, subscription rights) | 0,000040 |

Calculation of Points

B3 will keep track of the daily use of the available points. Upon completion of the 12-month timeframe for using the incentive, or upon full use of the points available, whichever comes first, B3 will resume charging all the exchange and other fees applicable to each transaction executed on a trader’s account according to the fee schedule in place.

Furthermore, the firms that participated in the Cycle 2018, Cycle 2019, Cycle 2020, 2021 and/or Cycle 2022 Programs must maintain, on a quarterly basis, a maximum correlation of 50% between the total number of contracts (among eligible products) traded in accounts benefited by the incentive and points used in regular accounts during the course of the New Traders Program Cycle 2023. This rule does not apply to firms that are joining the Program for the first time.

Example

Suppose that at the end of the 10th month of participation in the Program, a trader given 10,000 points has traded the following quantities of contracts:

| Product | Traded Contracts | Status |

|---|---|---|

| DI1 | 10,000 | 10,000 x 0.12 = 1,020 points |

| DOL | 5,000 | 5,000 x 0.67 = 3,350 points |

At the end of the 10th month of participation, the trader has spent 4,370 points out of a total discount of 10,000 points and has 5,630 points available for use within the following two months.

Traders Registered in the Cycle 2018, Cycle 2019, Cycle 2020, Cycle 2021 and Cycle 2022 Programs

The firms that participated in the Cycle 2018, Cycle 2019, Cycle 2020, Cycle 2021 and/or Cycle 2022 Programs must submit the Instrument of Agreement related to the New Traders Program Cycle 2023 to include new traders.

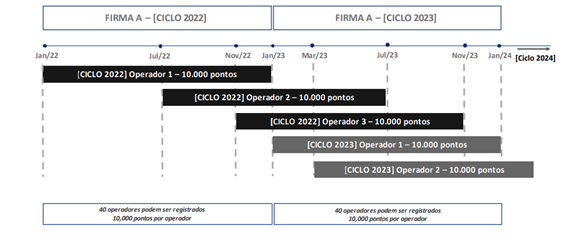

At any given time, traders of up to two cycles of the program may coexist under the same firm. In this case, there may be a number of traders per firm greater than forty (40).

Example:

Suppose that the same firm participates in both the New Traders Program Cycle 2022 and the New Traders Program Cycle 2023, its traders will be subject to the rules of the cycle in which they are registered.

In the scenario above, firm A will have traders registered under the rules of both the New Traders Program Cycle 2022 and the New Traders Program Cycle 2023 simultaneously between January 2023 and November 2023.

Further information about registration and the Program can be found in the following Circular Letter

The instrument for firm registration can be found in Instrument of Agreement – Firm.

The instrument for operator registration can be found in Instrument of Agreement – Trader