YOUR COMPANY CAN NOW REGISTER TRADE BILLS WITH B3

You can rely on the credibility of B3 Brazilian Stock Exchange and OTC to reduce the risks of your transactions and boost your business.

Our model brings a new level of efficiency in trade bill registration. We use our decades-long expertise to provide the financial market with the infrastructure to develop a system that offers solid information on transactions and optimizes the monitoring of those transactions.

KEY DIFFERENTIALS AND BENEFITS

When registering trade bills with B3 you ensure the stability, safety and operational know-how of the Brazilian Stock Exchange.

Here the entire registration process is done smoothly through a state-of-the-art and transparent system.

-

OPERATIONAL STABILITY

One of B3’s greatest values is to trade its products with quality and safety, besides using tools and skilled staff for quick problem identification and problem solving.

-

SMOOTH CUSTOMER SERVICE

You can talk to us using different platforms that provide up-close, quality service and an expert team specialized in Trade Bills.

-

B3 FOR DEVELOPERS

You can count on the B3 For Developers portal to find complete explanations and technical documentation to optimize your exchange of information with B3. It´s a real step-by-step guide to implement the development of smart solutions and interfaces in your company with maximum ease and transparency to boost your business.

HOW THE TRADE BILL MARKET WORKS

Every buy and sell transaction generates a payment obligation from the drawee to the drawer upon issuance of an Invoice. The Invoice can become a credit instrument and is used in credit transactions commonly found in the market.

- FURTHER DETAILS

We offer solutions for two types of trade bills: Mercantile Trade Bill, which is a bill originating from a buy and sell transaction of goods, and the Service Bill, which originates from the rendering of services.

With the aim of reducing risk and increasing information symmetry, Financial Institutions can use our Invoice validation and monitoring services, which becomes one of the steps in the credit release cycle.

After the transaction is cleared, the Financing Institution may also register the trade bill so that it can be committed with the market. This safety feature is provided only by authorized entities, such as B3 Brazilian Stock Exchange and OTC.

B3 SOLUTION

We have a simple and robust solution to serve financers and non-financial institutions.

Check out our platform functionalities below:

- FUNCTIONALITIES AND SOLUTIONS

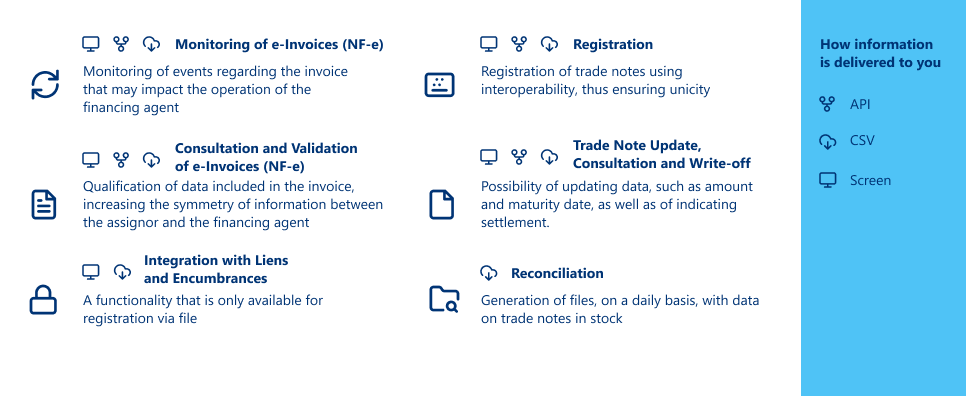

Among the functionalities and solutions offered by our Trade Bill services are:

- Qualification of the data contained in the invoice to increase data symmetry between the assignor and the financing agent.

- Monitoring of events on the invoice which may impact the financing agent’s transactions

- Trade bill registration using interoperability, thus ensuring the uniqueness of the process

- Possibility of updating data such as amount and expiration date, besides the indication of settlement

- Integration with liens and encumbrances if registration is done via file

- Daily generation of files containing data on available trade bills

For further information and technical documentation, see the B3 for developers. page