This policy is valid as of October 2, 2023

This policy only applies to those who are registered as High-Frequency Traders.

Accreditation

Investors that want to join the HFT Program must make their request through the full trading participant (PNP) or settlement participant (PL) (Participant) that settles their transactions and carries their positions. Accreditation of Accounts from trading participants (PN) is not allowed.

Participants are responsible for submitting requests on behalf of investors to B3’s Serviço de Atendimento and must also sign and file the Instrument of Agreement.

Only participants registered as PNP or PL may request the inclusion of their investors in the HFT program through the link: Submit Request (Exclusive PNP or PL)

The investor will be included in the HFT Program once B3 has approved the request. The Participant will be notified of B3’s decision by its Serviço de Atendimento.

After a successful request, all the investor’s accounts with this Participant will be registered in the HFT Program, including those that are created after the request. If the investor’s transactions continue to be settled via several Participants it must request inclusion in the HFT Program from all of these, through a request to B3’s Serviço de Antendimento contact center. Investors will only be registered after the request has been made by the Participants through whom their transactions are settled and their positions are carried.

Deadline for requests

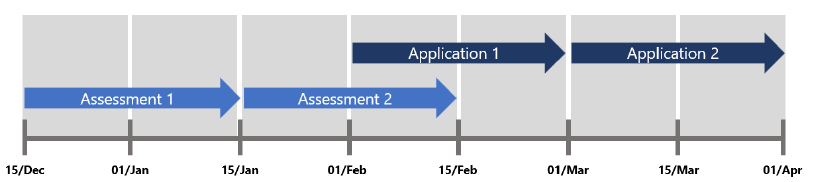

Investors that request the inclusion of all their participants by the 15th of every month will be registered in the HFT Program as of the first business day of the following month. If registering after the 15th, they will be registered on the first business day of the month after the next one.

De-accreditation

B3 will not assess the requirements for joining and remaining in the HFT Program. Interested investors will be included in the HFT Program in accordance with the rules above and remain in it until they wish to leave. Exclusion from the HFT Program shall occur through a request made to B3’s Serviço de Antendimento contact center. The investor will cease to be part of the HFT Program only after B3 concludes examination of the request and the Participant receives an email from B3’s Serviço de Antendimento contact center.

Calculation rules

Assessment period

The investor registered in the HFT Program will have access to the Program’s benefits, as long as it reaches the minimum ADV requirements and minimum day trades percentage. The assessment period for minimum requirements considers volumes traded as of the 16th of the previous month up to and including the 15th of the current month. The fee reflecting compliance or noncompliance with the requirements will come into effect as of the first business day of the following month:

ADV calculation

The calculation will be done according to the consolidation chosen by the investor (each broker or all brokers). This will be calculated by adding up the total of all traded contracts in a single family (buying and selling, day trading or not) during the assessment period, divided by the number of trading sessions in that period.

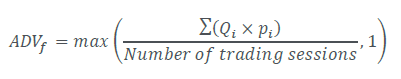

Each family of products has an ADV and each contract in the family has a weight for the ADV, which must be multiplied by the respective number of contracts traded in the period and rounded off to zero decimal places. ADV will be the quantities’ average adjusted by the weight of all the contracts in the family, with this calculation also rounded off to zero decimal places:

Where:

- ADVf = ADV of the family of products f;

- i = index that denotates each of the products of the same family;

- Qi = number of contracts traded for each product Family on each day of the period;

- pi = ADV weight for each contract of the family.

The values for the calculation of the ADV can be found on the HFT tables for each family.

The value calculated for the ADV will be used for the accounts registered in the HFT Program during the whole application month. The value of the fee to be paid will be based on this value until a new ADV is calculated.

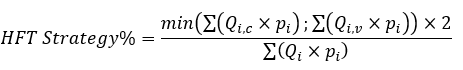

Percentage of HFT strategy

The assessment period also calculates, for each family, the percentage of HFT strategies. In this context an HFT strategy encompasses transactions matched with day trades as well as arbitrage with contracts in a same family. The HFT strategy is calculated from the minimum among the bought and sold quantities, adjusted by ADV weighting, multiplied by two, divided by the total traded volume in the period, adjusted by the ADV weighting. The result is rounded off to two decimal places.

Where:

- %HFT Strategy HFT = percentage considered to be strategies

- Qi,c = bought quantity of contracts of each product of the family on every day of the month

- Qi,v = sold quantity of contracts of each product of the family on every day of the month

- pi= weight of the ADV for each contract of the family

To be considered a strategy the quantity of contracts must meet the criteria found on the List of Documents.

Minimum requirements

| Family | Minimum HFT strategy | Minimum ADV |

|---|---|---|

| Dollar Family | 90% | 2,800 standard contracts / 14,000 minicontracts |

| Ibovespa Family | 90% | 1,500 standard contracts / 7,500 minicontracts |

| S&P 500 Family | 80% | 100 standard contracts / 2,000 microcontracts |

| Live Cattle (BGI) | 80% | 50 standard contracts |

| Arabica Coffee (ICF) | 80% | 25 standard contracts |

| Corn (CCM) | 80% | 150 standard contracts |

| Bitcoin (BIT) | 90% | 100 standard contracts |

Fee schedules

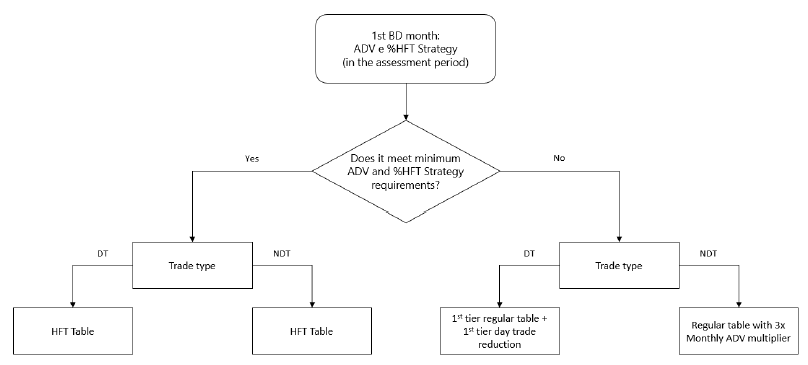

The fees applied to the trades will consider the observance of the minimum requirements and the type of trade:

HFT table

The product families that have special price tables are:

- Ibovespa

- U.S. Dollar

- S&P 500.

For the other families (Live Cattle, Arabica Coffee and Corn) investors on the HFT Program will have an additional reduction of 70% in relation to the value calculated for day trades, in accordance with the rules and tables defined for each contract.

Regular table

The values for the regular tables can be found on the List of Documents.

Exchange Fee and registration Fee

The step-by-step calculation for the exchange and registration fee can also be found on the List of Documents.