| Family | Product | Commodity | Risck factor | Contract factor | Day trade reduction | Settlement fee | Permanence fee | |

|---|---|---|---|---|---|---|---|---|

| p | λ | |||||||

| DI1 Futures | One-Day Interbank Deposit Rate Futures Contract | DI1 | See table | BRL1.00 | 70% | BRL0.01166 | BRL0.00816 | 0.73 |

| Trade at Settlement of DI1 Futures | DIT | BRL1.25 | N/A | N/A | N/A | |||

| Neutral DV01 Structured Product | DII | BRL2.00 | N/A | N/A | N/A | |||

| Neutral PU Structured Product | DIF | BRL2.50 | N/A | N/A | N/A | |||

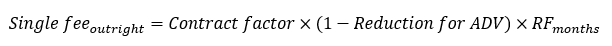

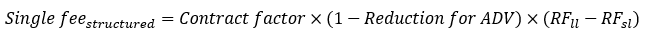

Calculation formulas

Risk factor table

| Months to expiration | Risk factor | |

|---|---|---|

| From | To | |

| 1 | 1 | 0.01 |

| 2 | 2 | 0.04 |

| 3 | 3 | 0.08 |

| 4 | 6 | 0.18 |

| 7 | 9 | 0.36 |

| 10 | 12 | 0.55 |

| 13 | 15 | 0.77 |

| 16 | 18 | 0.97 |

| 19 | 21 | 1.18 |

| 22 | 24 | 1.37 |

| 25 | 27 | 1.55 |

| 28 | 30 | 1.70 |

| 31 | 33 | 1.84 |

| 34 | 36 | 1.97 |

| 37 | 42 | 2.15 |

| 43 | 48 | 2.34 |

| 49 | 54 | 2.54 |

| 55 | 60 | 2.70 |

| 61 | 72 | 2.86 |

| 73 | 84 | 3.04 |

| 85 | 96 | 3.20 |

| 97 | 108 | 3.43 |

| 109 | 120 | 3.52 |

| 121 | 132 | 3.59 |

| 133 | 144 | 3.66 |

| 145 | 156 | 3.73 |

| 157 | 168 | 3.80 |

| 169 | 180 | 3.88 |

| More than 180 | 3.88 | |

Volume reduction table

| ADV | Reduction | Additional value | |

|---|---|---|---|

| From | To | ||

| 1 | 3,000 | 0% | 0 |

| 3,001 | 12,000 | 15% | 450 |

| 12,001 | 21,000 | 20% | 1,050 |

| 21,001 | 35,000 | 30% | 3,150 |

| 35,001 | 60,000 | 40% | 6,650 |

| 60,001 | 100,000 | 45% | 9,650 |

| 100,001 | 160,000 | 50% | 14,650 |

| 160,001 | 350,000 | 55% | 22,650 |

| 351,001 | 650,000 | 70% | 75,150 |

| More than 650,000 | 80% | 140,150 | |