B3 trading characteristics and rules

Trading Hours

Click here to view B3’s trading hours for the equities market

Collateral (margin requirements)

The collateral is equivalent to the amount of cash or assets that an investor uses to secure open position for a new trade. The advantage of collateral is the possibility of investing larger amounts than that held by the investor. This is called leverage. In addition to cash, some fixed income investments such as Tesouro Direto, Bank Certificates of Deposit (CDBs), Real Estate Letters of Credit (LCIs), Agribusiness Letters of Credit (LCAs) and Bank Letters of Credit (LCs) can be used as collateral. In this case, in addition to the expected return, the investor may also profit from other investments in which these assets are pledged as collateral.

Collateral may be foreclosed in the event the investor has an overdraft on its account. This is done so that the market as a whole is not harmed and all investors can honor the amount of their open positions.

Exposure limit

To ensure that trading participants set pre-trading limits and monitor clients trading in the markets managed by B3, regardless of the access format (DMA, Trading Desk or Order Conveyor), we offer the LINE 5.0 tool, which is integrated into the PUMA trading platform.

LINE 5.0 is intended for Full Trading Participants (PNP), Trading Participants (PN) and Settlement Participants (PL) who need to set pre-trading limits for their clients. These participants are the limiting setting agents. Additionally, all clients who send orders or have their orders sent to the trading system are LINE users as they have their limits validated before sending the order to the trading engine.

Pre-opening, pre-closing and fixing rules

The opening call begins 15 minutes before the auction opening session to ensure a fair price opening. The closing call, on the other hand, starts five minutes before the trading session closes in order to calculate a fair price to the close-out of the regular trading assets.

The criteria for theoretical price formation, also known as fixing, are described below:

First criterion: The auction price is the price at which the largest quantity of assets or derivatives is traded.

Second criterion: In the event of a tie on the first criterion, i.e., if there are two or more prices at which the same quantity of assets or derivatives is traded, the prices that create the smallest imbalance in the sale are selected, and in the interval between these prices the theoretical price is the closest to the price of the last trade, or in its absence the closest to the adjusted closing price or, for derivatives only, the closest to the settlement price for the trading session, rounded in accordance with tick size.

Third criterion: In the event of a tie on the first and second criteria, i.e., if there are two or more prices at which the same quantity of assets or derivatives is traded, and two or more prices at which the same imbalance is created on opposite sides, the auction price is the closest price to the price of the last trade among those that created the tie on the second criterion, or in its absence. the closest to the adjusted closing price or the closest to the settlement price for the trading session, rounded in accordance with tick size.

Characteristics

The characteristics of the theoretical price formation are described below.

- There is no pro-rata matching for orders at the same price, except as provided for by B3 in its trading procedures manual.

- B3’s trading system uses a price scale to set the theoretical price, which is as close as possible to the last price or the settlement price, where applicable.

- Bids that are equal to or higher than the theoretical price and asks that are equal to or lower than the theoretical price cannot be cancelled or have their quantity reduced but can be changed only to improve the price or increase the quantity, except in cases of correction and/or cancellation of orders by B3.

- Bids with a higher price than the theoretical price and asks with a lower price than the theoretical price are completely filled.

- Bids and asks at the theoretical price may be filled completely, partially or not at all, depending on the theoretical quantity for the auction.

- Disclosed quantity orders cannot be registered during an auction. Disclosed quantity orders registered before the start of an auction must comply with the priority rule for the quantity publicly quoted when they join the auction. If an order is modified, the total quantity must be disclosed to the market.

- Remainders of immediate-or-cancel (IOC) orders will be cancelled at the end of the auction.

Priority

The trading system uses the following priority rules to match trades subject to auction:

- Market-on-auction (MOA) orders for auctions and market-on-close (MOC) orders for closing calls are matched first. The balance of any such orders that are not completely filled when the auction begins is eliminated;

- Orders containing price limits have priority for matching at the same price level in accordance with the chronological sequence of their registration, except for orders originating with cancelled trades and re-entered by B3.

Auction extensions

The following events may justify an auction extension:

- A change in the theoretical price;

- A change in the theoretical quantity

- Registration of a new order that changes the filled quantity of a previously registered order;

- A change in the unfilled balance;

- Triggering of the protection tunnel;

- A decision by B3 to grant an extension*.

|

Extension criteria |

Extension time |

|

1st extension: If there is a change in one of the four criteria at the last minute (inclusive) |

Extends one more minute |

|

2nd extension: If there is a change in one of the four criteria at the last 30 seconds (inclusive) |

Extends one more minute |

|

3rd extension: If there is a change in one of the four criteria at the last 15 seconds (inclusive) |

Extends one more minute |

NOTES:

- Exclusively for the closing call period of the Electronic Trading System, the auction extension time, if the first criterion is met, i.e., if there is a change in one of the four criteria in the last 3 minutes (inclusive), the auction extension period will be 5 minutes, in accordance with Bovespa Circular Letter 052-2004; and

- B3 may extend or open an auction to preserve the regular development of trading.

Trading tunnels

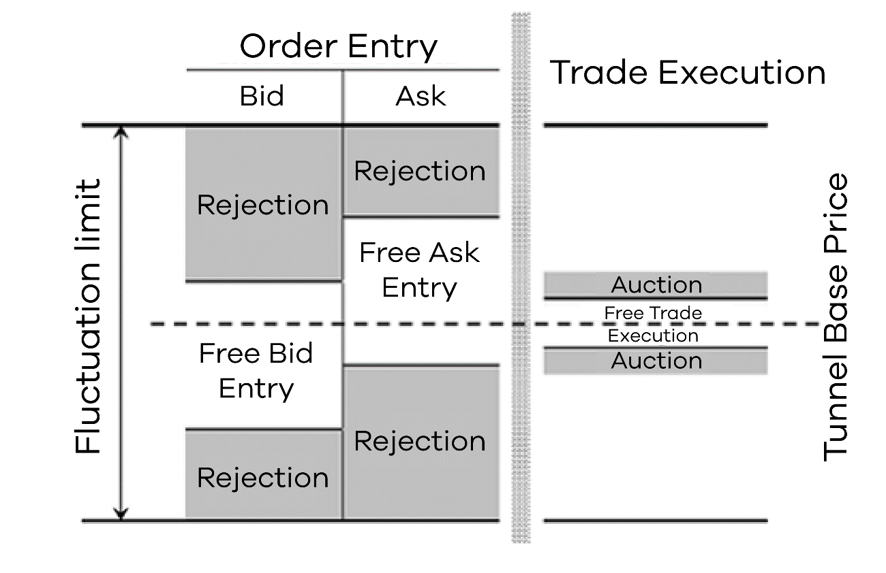

B3’s trading tunnel module is composed of rejection, auction and protection tunnels. The rejection tunnel is geared to the insertion of orders in the order book, the auction tunnel is geared to the execution of trades and the protection tunnel is applied during an auction.

Rejection tunnels

The rejection tunnels, as well as the current price fluctuation limits, determine the price region considered acceptable for trading purposes. However, unlike the price fluctuation limits which are static along a given day, rejection tunnels are updated dynamically, following the evolution of the market. This characteristic permits the use of narrower price intervals, resulting in a more efficient management of operational risk. Despite the implementation of rejection tunnels, fluctuation limits will continue to be in effect, since they have a different purpose in the risk management process.

Auction tunnels

Auction tunnels are an enhancement of the current intraday fluctuation limits. After a trade is executed, while its conformity to the intraday fluctuation limits is verified, the auction tunnels activate, at the imminence of the trade execution, an automatic auction in the trading system if the trade price is not within the price interval defined by the tunnel. The auction will use the quantity maximization algorithm, that is, trades will be executed in one single price. Thus, this new process will increase the speed and transparency of the trading environment.

Protection tunnels

The protection tunnel during an auction is the price variation interval established by B3, with the purpose of automatically extending the closing of auctions or the opening and closing calls, in the event that the theoretical price breaches the lower or upper limits. Limits are calculated by considering the price of the trade executed prior to the start of the auction or, when there is no auction, the closing or settlement prices of the contract.

Auction tunnels, rejection tunnels and protection tunnels are defined per instrument group. In the case of rejection tunnels, B3 may define one tunnel for a bid and another tunnel for an ask.

Independently of their purpose (rejection or auction), trading tunnels may be calculated either by the additive or the multiplicative method. In the former, a fixed value (bandwidth) is added to the instrument’s referential price in order to determine the upper tunnel limit, while in the latter it is subtracted from the referential price in order to determine the lower tunnel limit. When calculated by the multiplicative method, the lower and upper limits are obtained from the multiplication of the referential price by the factor based on a fixed value (bandwidth). The referential price, which is referred to as the tunnel base price (PBT), is defined as:

a) C-LAST, namely:

i. The last traded price, if it is between the best bid and the best ask; or

ii. The best bid, if it is above the last traded price; or

iii. The best ask, if it is below the last traded price.

b) Last Traded Price (LTP); and

c) Most Recent, that is, the last traded price or the referential price (the price calculated by B3 according to the methodology adopted by the contract), whichever has been updated most recently.

B3 may, if necessary, arbitrate the value of the tunnel base price.

Trading tunnel structure for an instrument

Messaging

All auction information, whether asset price, traded quantities or ticker is automatically triggered by the trading system via messaging. The messaging functionality brings greater transparency to trading.

Exchange Fees

Exchange Fees are fees charged by B3 on financial asset purchase and sale transactions. These fees are collected to pay for the costs involved in such transactions.

The percentage value of the exchange fee is calculated on the total volume traded. The amount varies according to:

- Type of trade: regular or very short term (day trades)

- Investor category: individual, funds or investment clubs

- The amount invested