02 - Interest Rates

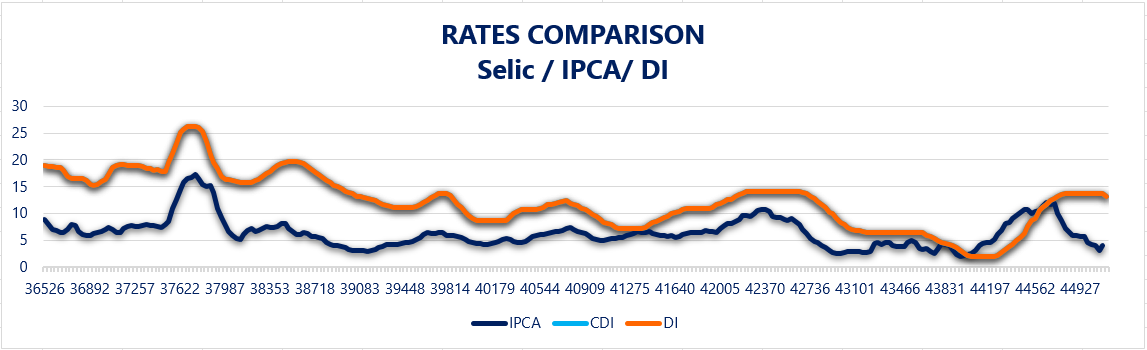

Interest rates in Brazil have their own peculiarities. Understanding this market is very important in order to fully comprehend the dynamics of the Brazilian economy. The country’s main interest rate benchmarks are the Selic rate and the DI rate.

- Selic rate: is the basic interest rate of the Brazilian economy and is defined by the Monetary Policy Committee (Copom), the team responsible for conducting the Brazilian Monetary Policy in force. The committee meets every 45 days to set the rate, which is valid until the next meeting. The Selic rate is used as a reference for daily financing rates secured by government bonds and calculated by the Special System for Settlement and Custody (Selic).

- Selic Over rate: is the average adjusted rate for daily financing rates calculated by the Special System for Settlement and Custody (Selic) for government bonds.

-

DI rate: is the average rate of interbank transactions carried out through interbank certificates of deposits. It is calculated based on fixed interbank deposits transactions settled within one business day.